Please see this page for the terminology I use to discuss the MRI conditions: https://focused15investing.com/language

Key observations as of last Friday (2/11/2022):

- The stock market is likely to be less resilient in the weeks ahead. The DJIA Loss-Avoiding algorithms are signaling greater vulnerability. Less resilience is likely despite the Micro MRI for the DJIA being in the upleg of it cycle and at a low level and poised to move higher.

- Bond prices are likely to decline further. The Macro MRI indicating the long-term trend for the US 10year bond index shifted to a negative trend, which indicates another drop in bond prices. Because bond prices move down when their yield moves up, declining bond price is consistent with the current condition of the US 10-year yield – its Macro MRI is currently in the upleg of its cycle (at the 61st percentile since 1962). Also, importantly, the Exceptional Macro for the 10-year yield appeared three weeks ago. With the Macro MRI for yields to be at the 61st percentile, it would not be unprecedented for yields to move higher for a few months.

- Commodities are likely to move higher. As of last Friday, the Exceptional Macro for the SPGS commodities index is now present. This shift was unexpected because the Exceptional Macro had ceased being present at the end of last November and the its end often foreshadows a shift to the downleg of a Macro cycle. However, the Macro is still in its upleg at the 74th percentile since 1974, suggesting that commodity prices could move higher for a few months. With the Macro and Exceptional Macro MRI still providing resilience, commodity prices could be resilient for a few months, regardless of the condition (upleg or downleg) of the Micro MRI.

- A measure of inflation expectations indicates higher inflation expectations over the next several weeks. I use a ratio of the Global Inflation-Linked Bond Index to the World Government Bond Index as the indicator of inflation expectations, which is a common industry practice. The Micro MRI for this series shifted to the upleg of its cycle as of last Friday and was at the 5th percentile since 1997, which suggests inflation expectations have been relatively low recently and will be higher over the next several weeks. Unfortunately, this index does not go back to the high inflation period of the 1970s and 1980s to capture expectations during that time. But the condition of this series is consistent with bond prices moving lower as the Fed tries to reduce inflation expectations by increasing interest rates.

- Gold is likely to move higher. The Macro MRI is in the upleg of its cycle and the Micro turned to the upleg of its cycle last Friday (at the 38th percentile of levels since 1976).

The observations mentioned above are consistent with further concerns about inflation and the Federal Reserve increasing interest rates. Higher inflation expectations can push commodity prices higher. Fed action to reduce inflation expectations by increasing interest rates could erode support for stock prices.

Market jitters about how all this plays out can result in gold prices moving higher. In Part III of the pdf, you can see on the Sleeve Profile for gold that its Macro MRI appears to be coming to the end of its recent downleg. Although not shown on the Sleeve Profile, the Exceptional Macro may be present in the next few weeks. If these shifts occur, gold prices will be more resilient.

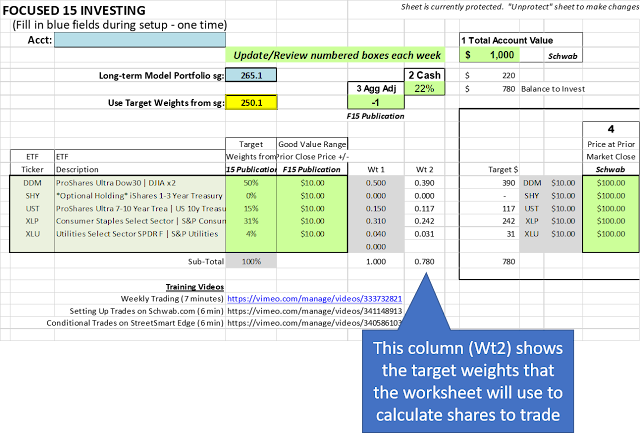

Because of these shifts, I have added two ETFs to the portfolios. PDBC is for a broad basket of commodities. GLD is for gold. You can see additional information about these ETFs in Part III of this week’s pdf. I have also imposed limits on the weight of the US 10-year bond ETFs to reduce interest rate sensitivity.

I have allocated 10% of each portfolio to the PDBC sleeve and 15% to the GLD sleeve. I may change these allocations over time depending on how jittery the markets become.

As an additional note about commodity prices, in addition to inflation concerns a possible cause of their resurging resilience might be geopolitical tensions. Russia is a major oil exporter and tensions related to Ukraine may be a factor in greater energy price resilience. If this is the case and tensions subside, energy prices may be somewhat less resilient. Also, if a military conflict takes place, I believe the Fed will be less aggressive about raising interest rates.

Note about PDBC: Some online information providers (those used by smartphone apps) show incorrect price history for this ETF. The chart below shows the price history from Bloomberg, which I believe to be correct.