The algorithms call for reducing weight to the DJIA-linked ETFs. This change is consistent with the DJIA’s recent move higher in a counter-trend rally. A counter trend rally means that, while the longer trend of the market is still down, the index price moves higher against that trend. The expectation is that the counter trend rally is temporary, and the market will be more vulnerable to declines over the next few weeks.

The long-term trend of the market became negative (as measured by the Macro MRI beginning the downleg of its cycle) in late November of last year. The timing of that inflection point coincides with when it was expected based on the dynamics of the market from 1940 to 2010. The downleg of the Macro MRI became more pronounced in January. At that time, there were only faint concerns about a war in Ukraine.

Once the Macro MRI is in a downleg, there are typically one or more counter trend rallies before the market reaches the low point of the downleg in the Macro MRI. I expected a counter-trend rally to begin in late January and one did occur at that time, and I designated a Plant season for just one week.

In mid-February, the Exceptional Macro MRIs for commodities and gold indicated strong “buy” signals. There were heightened concerns about inflation at that time, and we moved into the commodity ETF PDBC and the gold ETF GLD.

In late February, Russia invaded Ukraine, and this action resulted in concerns about reduced supply of commodities. This concern added further upward pressure on the prices of PDBC.

Recent Allocations to Commodity ETF PDBC

I mention this background because the investment rationale for holding commodity ETF PDBC shifted over the course of a few weeks. It went from a concern about inflation to a concern about both inflation and supply of key commodities, both of which are likely to cause PDBC to increase in price. With the supply of commodities, especially oil, affected by the war, the returns of PDBC will be more heavily influenced by the status of the war, OPEC, and potential government action to affect oil supply and price, such as releasing oil from the strategic reserves. Our process does not provide any insight into these variables and I thought it best to reduce our exposure to PDBC. I reduced the allocation to PDBC and increased the Box #2 Cash level.

Because of these concerns, I reduced the allocations to PDBC, and hold more GLD than PDBC. In a prior note, I mentioned that I may use a different ETF for commodities – I am not considering a switch at this time.

Higher Interest Rates May Help Precipitate the End of The Counter-Trend Rally

The stock market has moved sharply higher over the last two weeks. One might wonder if the market will move higher from here.

The Macro MRI for the DJIA is clearly in the downleg of its cycle and is likely to remain that way for several weeks or longer. From this perspective, the period of vulnerability is still present and I believe that we should consider the recent price appreciation as simply a temporary counter-trend rally.

Over the last eighteen months we have seen that government support for the economy has overwhelmed the natural cycles of resilience; the stock market did not decline during periods of vulnerability. However, I believe that there will be less government support going forward if the war stays contained.

Since the beginning of the pandemic, government support has come through stimulus payments and low interest rates. Both forms of stimulus have indeed produced economic growth. Along with that growth we also have a tight labor market and inflation. It is important to remember that the effects of government stimulus continue after the active stimulus has ended. Thus, we will see the positive aspect of stimulus, economic growth, and the negative, inflation, for some time.

The Fed is now speaking as though it will be very aggressive in increasing interest rates. Rate hikes can slow both the economy and inflation. It also means that the stock market is not likely to be buoyed by the low interest rates of the recent past.

When interest rates move higher, bonds decline in price. In the performance section below, you will see the year-to-date performance of two bond ETFs. UST is the ETF used in many of the model portfolios. It has lost about 14% of its value this year. The ETF IEF tracks the same set of bonds as UST (and TYD in Sapphire) but does not use leverage. IEF has lost about 7% this year. Many retirement portfolios have stable allocations to bonds and would have had losses in their bond segments this year. This is reflected in the relatively poor performance of the Vanguard funds VBINX and VASGX, shown below.

From the mid-1980s to the recent period, when the stock market did poorly, bonds tended to do well. Currently however, increasing interest rates that has a negative impact on the performance of both stocks and bonds. The Macro MRIs for both the DJIA and the US 10-year bond index are both clearly in the downlegs of their cycles. Thus, we are holding cash. This has helped our performance.

If the war in Ukraine continues and/or expands, the Fed may reconsider its harsh stance; it may not be as aggressive about raising rates. But at the moment, a more lenient Fed seems unlikely considering the very high inflation readings. Thus, both the DJIA and bonds are likely to follow their cycles of resilience, which means that both are vulnerable to declines.

The Utility stock ETF XLU and the Consumer Staples stock XLP are likely to follow a different path. Their MRI are decidedly more positive. Thus, this week we are shifting assets into those ETFs by reducing Box #2 Cash levels.

This picture – vulnerability for the DJIA and moderate resilience for the Utility- and Consumer Staples-linked ETFs – is most like early 2018 when the market had moderate declines that we want to avoid, but not major declines. I’ll describe this more in a future note.

Performance

The US stock market has declined from December 31, 2021 through last Friday, March 25, 2022. I have calculated the returns that one would get by following instructions since the beginning of the year for the “main” portfolios for each of the publications. Please see the endnote for a brief comment on the main portfolios.

The year-to-date returns as of 3/25/2022 are:

Diamond: -2.8%

Sapphire: -3.9%

These returns compare favorably to these alternatives:

DJIA: -3.6%

S&P500: -4.4%

NASDAQ: -9.3%

UST: -14.5% UST is the ETF for the US 7-10-year Treasury bond index, with 2x leverage

IEF: -7.6% IEF is the ETF for the US 7-10-year Treasury bond index, with no leverage

VBINX: -5.9% VBINX is a Vanguard Fund that has 60% of its assets in stocks and 40% in bonds

VASGX: -5.8% VASGX is a Vanguard Fund that has 80% of its assets in stocks and 20% in bonds

--------------------------

Note – Main Portfolios

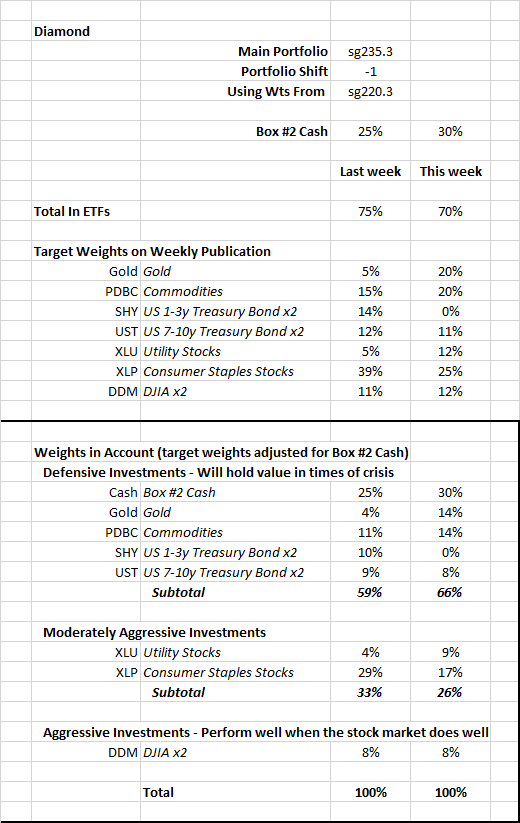

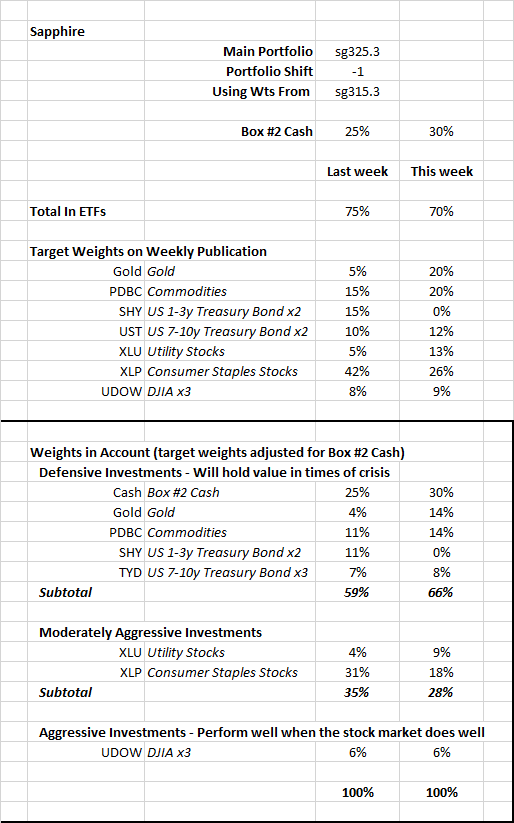

The main portfolio in the Diamond publication is sg235. The main portfolio in the Sapphire publication is sg325.

Some deviation between your account and the numbers above can be expected. The performance figures above assume trading is done at the close of trading on Fridays. Most people trade earlier in the day. In addition, we sometimes trade before Friday. If you use as your long-term portfolio one that is more or less aggressive than the main portfolio, your actual performance will be different.

The figures above are based on the actual ETFs in the model portfolio. The figures in the weekly publication are based on the index that the ETFs track.