Market Resilience, Naturally Occurring Shifts in

Sentiment, and Valuation

We expect greater market volatility over the next few

weeks, which may raise investor concerns that high stock valuations levels will

fuel a major stock market decline. While I share those concerns on an emotional

level, the data does not yet indicate that major declines are likely. The

reasons are:

- The Macro Market Resilience Index is still in the upleg of their its cycle and the Exceptional Macro is present. These conditions are positive for the stock market.

- The naturally occurring shifts in investor optimism likely to cause the volatility are currently only short-term in nature. The long-term trend continues to be for naturally occurring optimism

- While widely used valuation metrics are high compared to the last few decades, a long-term perspective shows that valuation metrics have trended higher. This trend makes it difficult to determine when valuation metrics are excessively high.

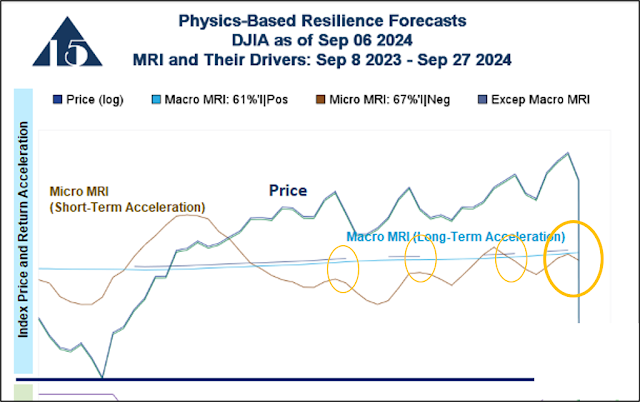

Current MRI readings and our forecasts of naturally occurring sentiment shifts are shown on page 3 of the weekly pdf. The upper panel shows that the Macro MRI and Exceptional Macro both indicate strong market resilience. While the Micro MRI is in the downleg of its cycles, there are no indications of stress based on its recent price action, which is used to determine the MRI.

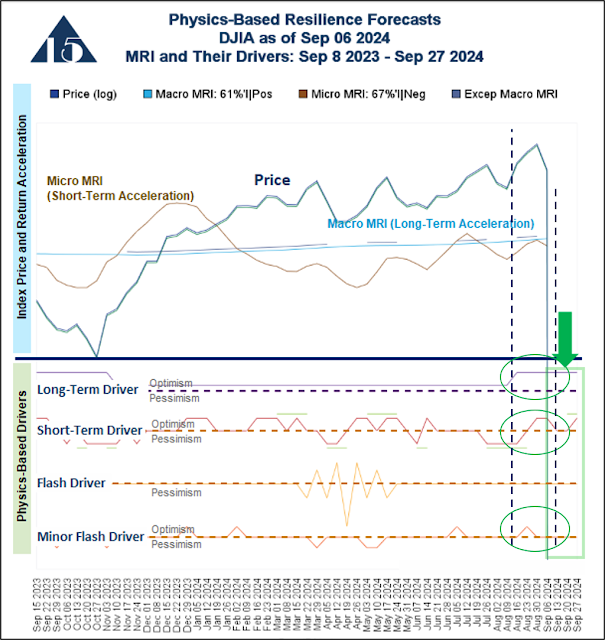

Page 3 also shows in the lower panel that the periods

of pessimism are likely to be temporary; the market will recover relatively

quickly from declines that do take place. The Short-Term Driver shown in the

lower panel of the graph indicates we will probably experience more ups and

downs in the market over the next few weeks. The Long-term Driver, however, indicates

that the longer-term shifts in sentiment will favor investors being

optimistic.

Thus, the markets may be more volatile over the next few weeks, but we should not get overly concerned that these will lead to deeper, more sustained losses.

Valuation

Greater volatility will be unsettling to many investors who

are already concerned about high valuations.

High valuations often precede market declines because investors come to

believe that stock prices are too high compared to corporate earnings and

company assets. With that widespread realization, there become more sellers of

stocks than buyers. Recent business news headlines reflect this concern:

- Fed's Rate

Cut Sends Already-Stretched Valuations Even Higher https://www.bloomberg.com/news/articles/2024-09-20/risk-appetites-rage-as-powell-proves-hero-in-high-priced-markets

Metrics we have used in the past point to currently high

valuation levels. Figure 1 below shows current valuations for the DJIA,

S&P 500 and NASDAQ for the data available through Bloomberg.

The table above presents a picture that reinforces the

concerns reflected in the headlines. Focusing on Price/Book and Price/Sales,

current levels are at or close to the upper end of their ranges, as indicated

by their high percentile levels.

However, there is objective data that dampens concerns about

current valuation levels. First, while

the above chart shows all the data available through Bloomberg, data is

available for earlier periods through other sources. Figure 2 below shows our

calculation of a statistic like Price/Book for US stocks beginning in

1926. The data is from Kenneth French at

Dartmouth. It shows that this valuation

metric has increased over time.

Figure 2

The most recent date for his data is early 2024, so we

cannot see the current reading, but we can see a clear trend of higher Price/Book

valuation levels over time. A similar image is seen in a metric that

approximates a Price/Earnings ratio, as shown in Figure 3 below for years

beginning in 1951.

While the extended timeframes shown above provide a broader context, our own research may be more compelling. It indicates that

we are currently in a phase of the stock market during which most investors are unusually

tolerant of high valuation metrics. More specifically, the Price/Earnings ratio for the S&P 500 is significantly higher during phases like the our current phase compared to all other phases of the market since 1940. Yet, the rate of economic growth during prior similar phases is not any higher than in other phases. This supports our view that these dynamics have a strong component of investor emotion as opposed to a view of economic forces. The difference in valuation ratios is a statistically significant finding.

We expect this period of tolerance for high valuation levels to last for

several more quarters. Please reach out

if you would like more information about this research.

Investors in general, are behaving as though one or both of the following are true:

- There has been a long-term trend toward higher stock valuations, and this trend will continue. In this context, current valuations are not excessively high.

- During this phase of the market, investors are simply more tolerant of high valuations. Since this phase is expected to last several more quarters, these high valuations are not worrisome.

- The pandemic stimulus has elevated valuations, and once its effects have fully worked through the economy—potentially leading to an economic slowdown—valuations will decline.

The third is our primary concern. However, as time passes and we

observe how the economy evolves, we will better understand the magnitude of

this potential factor contributing to high valuations.

End