Portfolios have higher allocations to the gold ETF “GLD” and the commodities ETF “PDBC.” These ETFs already have or will soon have positive Exceptional Macro MRIs, which means their prices are very resilient. This MRI condition is consistent with current market dynamics. Gold tends to do well in times of global stress and/or inflation. Commodity prices are likely to increase because of sanctions against Russia, a major commodity exporter.

These are temporary holdings. The commodity ETF invests primarily in energy (crude oil, gas) and high commodity prices can inhibit growth and further demand for commodities leading to price declines. As mentioned in prior notes, the algorithms driving our investment in commodities were developed in 2008 and 9. They have been successful over the years in identifying buy and sell points. But energy prices are volatile and we can expect the price of the commodity ETF to move up and down.

From the narrow perspective of the stock markets around the

world, the war in Ukraine is coming at an unfortunate time because the natural

cycles of resilience are shifting to a more vulnerable phase. This means that even if there are positive

news events related to the conflict, any jump in prices is likely to be

temporary. If there is negative news,

prices are likely to fall.

In more normal times, we would have seen a counter-trend rally over the last four or five weeks and extending for a few more weeks. A counter-trend rally is a temporary rally in stock prices that would fades as the market resumes a downward trend. In this case, the downward trend began at the end of December 2021 and it likely to continue for a several weeks more.

The war, inflation concerns, and high stock valuations have weighed on the market and likely subdued the counter-trend rally. Because of this, we are running out of time for that temporary rally to occur. While a counter-trend rally may still happen, it will be short and difficult to capture without experiencing the subsequent price declines.

I believe it is unlikely that the markets will shift to a strong positive trend from here. Investors globally will need time to adjust expectations for growth, interest rates, inflation, and fair stock prices considering geopolitical events. The upcoming period of vulnerability may induce some panic, which could cause stock prices to drop more than the figure above. I believe there will be a better time in the future to be aggressive in our portfolios.

Considering these dynamics, I have reduced portfolio aggressiveness over the last few weeks. This period of vulnerability is likely to last several weeks.

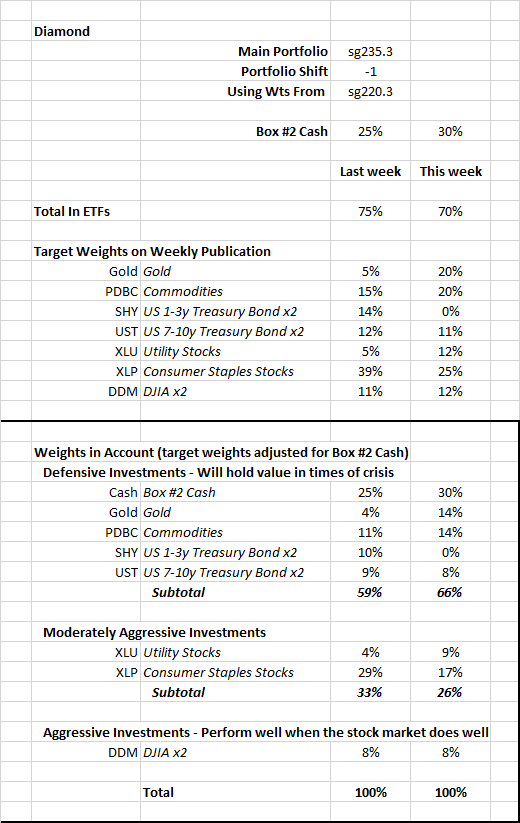

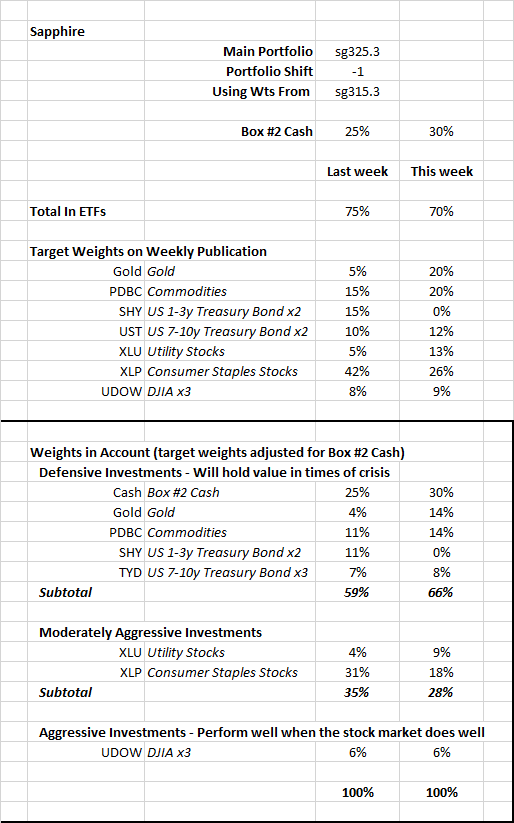

Because of the recent changes in the portfolios and the weekly reports, it may be difficult to get a sense of how defensive the portfolios are. The tables below show the target weights from last week and new target weights for the ETF; the ETFs are grouped by how they are likely to perform during this crisis and a vulnerable stock market. There is one table for the Diamond and one for the Sapphire main portfolios. Don’t be concerned if you don’t follow all the details of the table. The key points of this table are in the highlighted boxes:

- Our portfolios have been conservative (or Defensive) for the last few weeks

- This week’s target weights call for:

- Two-thirds of our accounts are in Defensive ETFs that may move higher in times of crisis, including large weights in gold and commodities.

- Less than 10% is in Aggressive ETFs

“Defensive” ETFs are likely to hold and perhaps increase in value a stock market decline or a crisis such as the current one.

“Moderately Aggressive” ETFs may experience losses but will move higher should the stock market declines be small and the Ukraine-related crisis be less severe than it currently appears.

“Aggressive” ETFs will move higher on renewed optimism in the stock market.