Starting April 14, 2023, we will include the Bitcoin ETF “BITO” in the Sapphire publication as a opportunistic addition. We plan to add it to the other publications over the subsequent weeks.

The Macro MRI for Bitcoin is currently at a low level in its cycle and has recently shifted to the upleg of the cycle. Bitcoin adheres to the same principles found in our main stock and bond investments such as the DJIA and the US 10-year Treasury Bond index. To date, its price movement follows closely the cycles of optimism and pessimism tracked by its MRI.

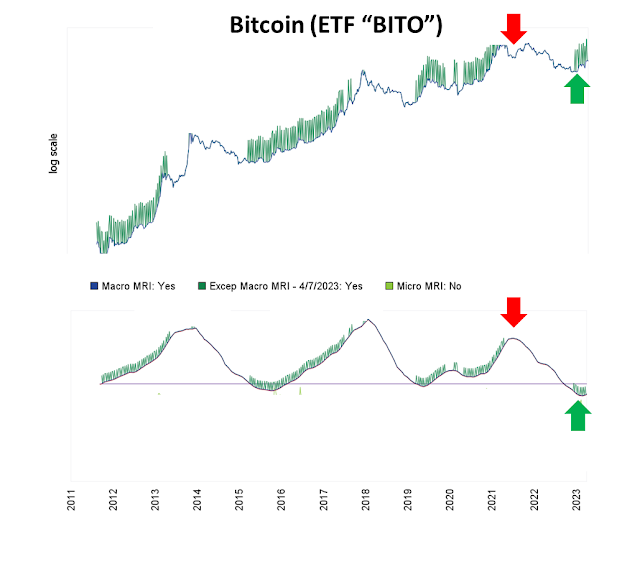

The upper panel in the figure below displays the price of Bitcoin on a log scale from 2011 through April 7, 2023. The lower panel shows the Macro MRI for Bitcoin. The vertical green lines in both panels indicate the periods when the Exceptional Macro MRI is present. During such times, we typically see the investment increase in price more quickly and be less sensitive to the short-term periods of resilience tracked by the Micro MRI, which is not shown for clarity.

The red arrows indicate the timing of the most recent

peak in the Macro MRI, and the green arrows indicate the most recent

trough. The recent trough has been at the lowest point on record for Bitcoin.

If the cycle moves towards its average value, the price of Bitcoin will likely

increase from this point.

Bitcoin is an investment that has value simply because many investors believe it has value and there is limited supply, much like gold. Neither gold nor Bitcoin pays those who hold them dividends (like stocks) or interest (like bonds).

However, Bitcoin's price behavior is more fully explained by its MRI than is gold's. This important attribute makes it a better fit for our portfolios than gold.

A disadvantage of Bitcoin is its short history, which begins in 2011. Gold has been a valuable asset for thousands of years.

In addition, neither gold nor Bitcoin have valuation concerns and may respond more fully to the upward movements in the MRI without being encumbered by high valuations, which currently plague stocks. High valuations may put a lid on on stock price increases despite the markets being more resilient.

Despite its short history, Bitcoin is sufficiently attractive to include in our portfolios because of the predictability of its price cycles. However, should it no longer follow its MRI, we will remove it from our portfolios.