Last week marked four years since the start of the Focused

15 Investing publication. This report provides

information about how the investment approach has worked over this period. This report discusses the performance of two

model portfolios for the 4-year period ending July 20, 2018 and compares them

to various reference points. An appendix

also shows results for all portfolios currently listed in Focused 15 Investing

publications.

The two model portfolios are:

- Diamond (sg131), which is the most widely used model portfolio. It holds three ETFs. The signal set that drives Diamond, which I call “D5”, is the primary loss-avoiding component used in all model portfolios. It is designed to provide high absolute returns and avoid losses.

- “US Ind, LC/SC, Multi-Sector Bonds” (sg129). It holds eight ETFs and places greater emphasis on maintaining its performance advantage in upward trending markets. It includes the D5 signal set but also includes relative leadership sleeves for 1) large company (LC) vs. small company (SC) stocks, and 2) various bond sectors. Loss avoidance is not its primary goal. Portfolio sg129 was in the original publications 4 years ago. It is in the publication for institutional investors, which focuses on model portfolios aiming to provide strong returns relative to a benchmark.

Annualized

Return

%

|

%

|

Maximum

Drawdown[3]

%

|

|

Higher is better

|

Lower is better

|

Smaller loss is better

|

|

Diamond

(sg131)

|

25.4

|

14.1

|

-15.6

|

Sg129

|

15.1

|

11.0

|

-13.8

|

As one can see in the table above, Diamond has a much higher

return than sg129 (25.4 % vs. 15.1%). At

the same time, sg129 had a loss (maximum drawdown) just about as great as Diamond’s.

Before discussing the performance of these model portfolios over

the last four years, I’ll review the market environment.

Market Environment

The recent four-year period has seen above average

rates of return and below average return variability compared to the

last roughly 100 years of the DJIA. The

chart below shows the Price of the DJIA (brown line) on the left-hand scale

(log).

The chart also shows the percentile rank of the rolling

4-year returns for the DJIA (green) across the 100-year period and the

percentile rank of the variability of the 4-year returns (yellow), both on the

right-hand scale (the horizontal black

line is at the 50th percentile on the right-hand scale ranging from

0.00 to 1.00). The rightmost point of

the green line indicates that the 4-year return for the DJIA is at the 64th

percentile – a moderately high return.

The rightmost point on the yellow line indicates that the variability of

returns is at the 33rd percentile – a moderately low level of

variability.

Source: Bloomberg LLC and CPM Investing LLC

Generally speaking, Diamond produces better returns than its

default when the market’s variability (yellow line) is high. Portfolio sg129 is designed to do better when

the market’s returns (green) are high. This

information indicates that the environment was more favorable to model

portfolio sg129 than to Diamond. Diamond

has just three ETFs and is designed to avoid losses during periods of high

return variability.

In contrast, model portfolio sg129 (eight ETFs) is designed

to outperform its default in positively trending markets, such as what we have

experienced the last 4 years. That said,

the absolute return of Diamond is higher, making it attractive to end users in

many environments.

Traded Portfolios Compared to their Defaults

The chart below shows the performance of Diamond and its

default. The blue line represents the

performance of using the dynamic target weights in the weekly publication. The tan line indicates the performance of the

same ETFs held at default weights over time.

As indicated in the material describing the Focused 15 Investing approach,

the traded portfolio (blue line) can underperform its default (tan line) in the

later stages of an upward trending market.

We can see this below in the narrowing of the gap between the traded and

default over time. In a strong upward trending market, the line for the traded model (blue) could even pass behind the line for the default (tan).

The traded portfolio had less volatility (13.2% vs. 17.2%

for the default). As a result, the

traded portfolio had a ratio of return-to-variability (RoR/Var) of 1.42 compared to 1.07 for the default. The value 1.42 is good for the RoR/Var ratio (see section “Funds in Bloomberg with High Return-to-Variability Ratios” for more information about interpreting this statistic).

The graph below shows the same information for sg129. As it was designed to do, the traded

portfolio maintained its performance relative to the default in the later

stages of the recent ascending market.

The table below shows that the traded portfolio had higher

returns (12.0% vs. 10.2%, annualized) and lower variability (9.0% vs. 11.5%,

annualized) relative to its default.

Correspondingly, the RoR/Var compares favorably at 1.32 vs. 0.89 for the

default. Also, the traded portfolio had a

smaller maximum drawdown over this period (down 7% vs. down 13%).

Traded Portfolios Compared to Select Retirement-Focused Funds

This section shows the return of these two model portfolios

compared to two alternatives, which I selected as comparisons years ago based

on what one might obtain in a company-sponsored retirement plan. The two retirement-oriented plans are:

- VBINX - Vanguard’s ETF with a 60% stock and 40% bond mix (Vanguard 60/40)

- Russell LifePoints Growth Fund, designated as “RLP – Growth” below. This fund is the most aggressive of the LifePoints funds

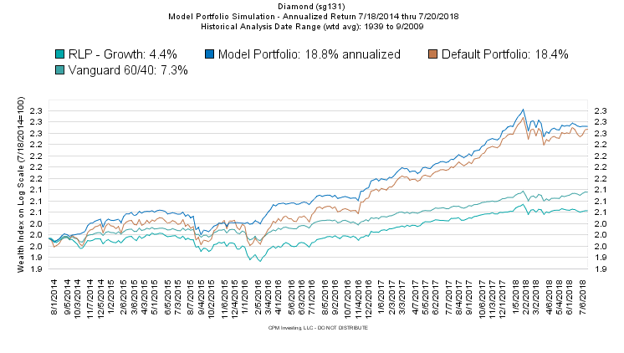

The chart below shows Diamond compared to these two funds:

These funds are more conservative than Diamond; the returns

are not as high. But it is important to note

that the RoR/Var ratio for Diamond is higher than for any of the others. This means that Diamond provides higher returns

for the level of variability that must be endured. Also note that the maximum drawdowns over

this period for Diamond and the Russell LifePoints were about the same (down

16%).

The chart below compares these two alternatives (VBINX and

RLP-Growth) to sg129.

The variability of sg129 (9.0%, annualized) is less than that

of the Russell LifePoints’ (9.2%), but sg129’s return is quite a bit higher

(12.0% vs. 4.4%, annualized). The

RoR/Var ratio for sg129 (1.32) is higher than all others.

Funds in Bloomberg With Returns Similar to Diamond’s

The table below shows that, on average, these 11 funds had a return of 18.9%, which coincidentally matches Diamond’s return for the period. The average variability of the group is 26.8%, which is

more than double Diamond’s 13.2%.

Some of Diamond’s low variability is because of its diversified nature – it holds an allocation to bonds. I had hoped this search of Bloomberg data would have surfaced aggressive balanced funds (holding both stocks and bonds) that may be more directly comparable to Diamond. None were found, and I confirmed this with Bloomberg. It appears that those funds don’t exist in Bloomberg.

Diamond’s RoR/Var ratio is high compared to the average for

these investments (1.4 vs. 0.72).

The ETF DDM, which is the main ETF in Diamond just misses

being on this list. It returned 22.8% (annualized)

over this period. Its variability was

24.9%, which gives it a ratio of 0.92.

Funds in Bloomberg With High Return-to-Variability Ratios

In order to evaluate the four-year RoR/Var ratios of the two Focused 15 Investing portfolios, I estimated a corresponding statistic based on data available in the Bloomberg databases. I filtered for funds with a North American focus, in US dollars, that are domiciled in the US. In Bloomberg, “funds” include mutual funds, closed-end funds, ETFs, and a range of other fund types. The result was 8,507 funds.

Bloomberg statistics are slightly different than the ones I use[4]. Bloomberg provides three-year and five-year statistics, but not four-year. I estimated the four-year statistics as the average of the three-year and five-year statistics.

The table below shows sections A and B. A shows the percentage of the 8,507 funds estimated to be in the range indicated for RoR/Var, “1.1 to 1.2” for example. B shows the percentage exceeding a certain level, “Higher than 1.2”, for example.

Based on these reference points, Diamond’s RoR/Var ratio of 1.42 and sg129’s of 1.32 place them among the upper 3% and 6%, respectively, of the pool of 8,000+ funds tracked by Bloomberg.

Morningstar ETF Managed Portfolios – Three-Year Return through 12/29/2017

I also compared Diamond and sg129 to funds tracked by Morningstar that are in the class they call “ETF Managed Portfolios.” Like the Focused 15 Investing portfolios, these funds consist of multiple ETFs. Morningstar indicates that they ignore whether the ETFs are leveraged.Morningstar produces a report showing performance, but the most recent report available is for fourth quarter 2017. The overlapping period with the Focused 15 Investing portfolios is the three years ending that date (12/29/2017).

In the report, Morningstar tracks 1,180 ETF-based funds across a range of different attributes and classifications, shown below.

Of those with a three-year history (the report does not say how many have that length of history), the top 10 performers across all classifications listed above have annualized returns ranging from 11.34% to 17.92%.

Over the same three-year period, Diamond returned 21.0%, and sg129 returned 12.8%. If I reduce these returns by, say, 1.5% for fees, we get Diamond at 19.5%, and sg129 at 11.3% – figures that still place them among the top ten performing funds shown below.

The table below shows the top ten funds in the Morningstar report. (The bottom-performing ones referred to in the title of Exhibit 6 are not relevant and therefore are not shown.)

Conclusion

While the US stock market, as measured by the Dow Jones

Industrial Average, has seen strong returns and low variability over the last four

years, Focused 15 Investing’s model portfolios have demonstrated better

performance characteristics than their default mixes.

The performance of both Diamond and sg129 over this period

has been consistent with their designs. Diamond is designed to avoid losses and

have high absolute returns rather than to outperform its default in an upward

trending market. While Diamond had strong absolute returns for the period, it

had a rate of return similar to its default mix, but with less variability. On

the other hand, sg129 is designed to maintain its outperformance during upward

trending markets. This was reflected in

the portfolio’s performance; while sg129 had lower absolute returns, it showed better

performance relative to its default mix.

The two Focused 15 Investing portfolios have also performed

better than select retirement-oriented funds. This is indicated in the

comparison to Vanguard’s VBINX and Russell’s LifePoints Growth funds.

While obtaining directly comparable performance information

for a large number of funds is difficult, the data available from Bloomberg and

Morningstar suggest that the Focused 15 Investing model portfolios are among

the strong performers over the last four years.

-----------------------------------------------------------------------------------

Appendix: Appendix: Model Portfolio Performance by Focused 15 Investing Publication

- The main US Dollar (USD) publication.

- Institutional Investors. These model portfolios tend to have a higher number of ETFs and emphasize performing well relative to their default mixes. Please note: Model portfolio sg99 was in the original publication along with sg129. Portfolio sg99 is designed for low variability and to have fewer ETFs than sg129.

- Investors in Australia. These portfolios focus on improving the RoR/Var ratio and keeping trading frequency low.

- Investors in Japan.

1. Focused 15 Investing - USD

Model Portfolio Performance Since

7/18/2014 as of 7/20/2018

Diamond - 3 ETFs (sg131)

Ann RoR Ann Var

RoR/Var

Traded 18.7 13.2

1.4

Default 18.4 17.2

1.1

Sapphire - 1 ETF (sg147)

Ann RoR Ann Var

RoR/Var

Traded 23.1 17.1

1.3

Default 23.0

22.6 1.0

Emerald - 2 ETFs (sg148)

Ann RoR Ann Var

RoR/Var

Traded 21.5 15.8

1.4

Default 20.4 20.0

1.0

Ultra Diamond - 3 ETFs (sg174)

Ann RoR Ann Var

RoR/Var

Traded 26.4

18.7 1.4

Default 25.4 25.1

1.0

Diamond-Onyx - 5 ETFs (sg176)

Ann RoR Ann Var

RoR/Var

Traded 12.7 8.2

1.5

Default 12.4 10.9

1.1

Mosaic - 8 ETFs (sg213)

Ann RoR Ann Var

RoR/Var

Traded 11.0 9.7

1.1

Default 6.0 13.6

0.4

2. Focused 15 Investing - Inst'l Pro USD

Model Portfolio Performance Since 7/18/2014 as of 7/20/2018

US Ind, LC/SC, MS

Bonds - 8 ETFs (sg129)

Ann RoR Ann Var

RoR/Var

Traded 11.9 9.0

1.3

Default 10.2

11.5 0.9

US Ind, US

Ind/Trans, MS Bonds - 7 ETFs (sg99)

Ann RoR Ann Var

RoR/Var

Traded 6.4 6.2

1.0

Default 8.2

9.9 0.8

DJIA x2, US

Ind/Trans - 5 ETFs (sg150)

Ann RoR Ann Var

RoR/Var

Traded 9.7 7.4

1.3

Default 11.3

11.3 1.0

DJIA x2, EME/B,

Com, L Vol Sctrs - 8 ETFs (sg113)

Ann RoR Ann Var

RoR/Var

Traded 13.0 9.0

1.4

Default 10.5

12.9 0.8

DJIA, EM E/B,

LC/SC, MS Bonds - 10 ETFs (sg122)

Ann RoR Ann Var

RoR/Var

Traded 10.4 7.2

1.4

Default 8.0

8.9 0.9

DJIA x2, LC vs SC,

Onyx - 7 ETFs (sg204)

Ann RoR Ann Var

RoR/Var

Traded 16.3

10.7 1.5

Default 14.6

13.9 1.1

Simulated

performance since the inception of the newsletter July 18, 2014

3. Focused 15 Investing - Professional AUD

Model Portfolio Performance Since 7/18/2014 as of 7/20/2018

IEM, IVV - 4 ETFs

(sg98)

Ann RoR Ann Var

RoR/Var

Traded 10.5 7.2

1.4

Default 10.4

10.2 1.0

IEM, IVV, VLC/VSO -

6 ETFs (sg172)

Ann RoR Ann Var

RoR/Var

Traded 10.7 7.7

1.4

Default 11.3

10.5 1.1

MXAU, IVV, VLC/VSO

- 5 ETFs (sg71)

Ann RoR Ann Var

RoR/Var

Traded 3.7 6.1

0.6

Default 5.5

9.3 0.6

MXAU, VLC/VSO, EM

E/B - 8 ETFs (sg183)

Ann RoR Ann Var

RoR/Var

Traded 6.5 6.9

1.0

Default 7.0

9.5 0.7

VLC/VSO, EM E/B - 5

ETFs (sg187)

Ann RoR Ann Var

RoR/Var

Traded 10.7 8.4

1.3

Default 9.2

9.0 1.0

Currencies - 3 ETFs

(sg184)

Ann RoR Ann Var

RoR/Var

Traded 1.1 4.2

0.3

Default -3.8

9.3 -0.4

Simulated

performance since the inception of the newsletter July 18, 2014

4. Focused 15 Investing - Professional JPY

Model Portfolio Performance Since 7/18/2014

Diamond JPY - 4 ETFs (sg185)

Ann RoR Ann Var RoR/Var

Traded 22.1 17.3 1.3

Default 18.1 23.0 0.8

Emerald Impact - 3 ETFs (sg186)

Ann RoR Ann Var RoR/Var

Traded 23.3 20.7 1.1

Default 20.4 26.7 0.8

Simulated performance since the inception of the newsletter July 18, 2014

4. Focused 15 Investing - Professional JPY

Model Portfolio Performance Since 7/18/2014

Diamond JPY - 4 ETFs (sg185)

Ann RoR Ann Var RoR/Var

Traded 22.1 17.3 1.3

Default 18.1 23.0 0.8

Emerald Impact - 3 ETFs (sg186)

Ann RoR Ann Var RoR/Var

Traded 23.3 20.7 1.1

Default 20.4 26.7 0.8

Simulated performance since the inception of the newsletter July 18, 2014

[1] All performance figures for

Focused 15 Investing model portfolios are based on returns of the indexes that

the ETFs track and the weekly target weights for the ETFs. The performance figures do not reflect costs

and fees, such as fees collected by the ETF providers, trading costs for

implementing the model portfolio in accounts, and fees for the Focused 15 Investing

publication.

[3] Maximum Drawdown indicates

the greatest loss over the time period indicated. It is determined by finding the greatest gap

between a high price level and the next subsequent low-price level.

[4] I use weekly return data to create a simple ratio of annualized return to annualized standard deviation of returns. Bloomberg reports annualized monthly statistics and reports only 3y and 5y Sharpe Ratios. I do not subtract the risk-free rate in my calculations, a difference that is less meaningful during the current period of low short-term rates.

[4] I use weekly return data to create a simple ratio of annualized return to annualized standard deviation of returns. Bloomberg reports annualized monthly statistics and reports only 3y and 5y Sharpe Ratios. I do not subtract the risk-free rate in my calculations, a difference that is less meaningful during the current period of low short-term rates.