The markets are likely to go through a process of

recalibrating stock and bond prices to accommodate higher inflation, higher

interest rates, and a Fed that is less willing to step in with support when the

economy or capital markets feel distress. Stock prices may experience downward pressure

when faced with higher interest rates but upward pressure with stimulus-induced

economic growth. All else equal, downward pressures will result in sharper market

declines during a period of unusually low resilience that I expect to begin in

December.

We may find that stimulus-induced strong economic growth more than compensates for the lack of resilience - and we may miss some positive returns if this happens. But our philosophy is to reduce our exposure to stocks when the market is vulnerable. Moving in and out of stocks

is cheap and easy to do. We need to be looking ahead to the period after the next Plant

season when it is appropriate to be aggressive.

This

post discusses the current situation and a possible future condition that will be more economically rational and, I believe,

better for the economy, for stocks, and for our portfolios. I believe we need

to adjust our thinking to this emerging new reality because parts of it have not

been experienced for decades.

Sharp Minds Expect a

Deep Decline in Stock Prices

Jeremy Grantham is a well-respected investor thinks

it will be big. Here is a Q and A he had with Reuters in July 2021

(https://www.reuters.com/business/bubbles-bubbles-everywhere-jeremy-grantham-bust-ahead-2021-07-20/):

· Q:

What is your take on equity valuations now?

· A:

Looking at most measures, the market is more expensive than in 2000, which was

more expensive than anything that preceded it.

· My

favorite metric is price-to-sales: What you find is that even the cheapest

parts of the market are way more expensive than in 2000.

· Q:

What might bring an end to this bubble?

· A:

Markets peak when you are as happy as you can get, and a near-perfect economy

is extrapolated into the indefinite future. But around the corner are lurking

serious issues like interest rates, inflation, labor and commodity prices. All

of those are beginning to look less optimistic than they did just a week or two

ago.

· Q:

How long until a bust?

· A:

A bust might take a few more months, and, in fact, I hope it does, because it

will give us the opportunity to warn more people. The probabilities are that

this will go into the fall: The stimulus, the economic recovery, and

vaccinations have all allowed this thing to go on a few months longer than I

would have initially guessed.

· What

pricks the bubble could be a virus problem, it could be an inflation problem,

or it could be the most important category of all, which is everything else

that is unexpected. One of 20 different things that you haven't even thought of

will come out of the woodwork, and you had no idea it was even there.

· Q:

What might a bust look like?

· A:

There will be an enormous negative wealth effect, broader than it has ever

been, compared to any other previous bubble breaking. It's the first time we

have bubbled in so many different areas – interest rates, stocks, housing,

non-energy commodities. On the way up, it gave us all a positive wealth effect,

and on the way down it will retract, painfully.

I have met Jeremy a

few times for one-on-one conversations and have a great deal of respect for

him. He has a strong interest in valuations and has often been early in prior calls for markets to decline.

I believe it will be a shift in resilience that starts the

bubbles to pop. Based on the MRI research, the timing of that period of low resilience is likely upon us now. My theory of what pops the bubble is different than his, and I will discuss it in a future post.

Inflation Is Now Increasing

Inflation has been in

the news recently. This month’s inflation reading is expected to indicate that

prices have moved up over 6% since last year, the highest rate since 1991. (https://finance.yahoo.com/news/consumer-price-index-what-to-know-this-week-190934215.html)

I believe there will

be higher inflation and that a good case can be made that there should

be higher inflation for an extended period, and Powell would probably agree with me on this.

Powell as an Inflation

Fighter

Many articles on

Powell’s recent reappointment focused on the need to battle inflation, as

indicated by headline: “Biden Picks Jerome Powell to Lead the Fed for a Second

Term as the US Battles Covid and Inflation.”

(https://www.cnbc.com/2021/11/22/biden-picks-jerome-powell-to-lead-the-fed-for-a-second-term-as-the-us-battles-covid-and-inflation.html)

I believe that the

Fed’s efforts to fight excessive inflation are important. They should strive to

keep inflation from getting out control as it did in the 1970s. But I also

believe the ultimate goal of the Fed and the policy makers around the world will not be

extremely low inflation, such as the low levels of the 2008 to 2018 period - but

instead a moderate level of inflation. A level of 2 to 4 percent might be more

realistic for a protracted period.

Global Economies Have

Recently Confronted Something Worse than Inflation: Deflation

After the global

financial crisis in 2008/9, inflation declined so much that the major concern

among central banks around the world was not inflation but deflation – where

prices decline over time. While this sounds good, it tends to harm economic

growth. When consumers get a sense that prices will be lower in the future,

they put off purchase to wait for better prices. When they do that, production

declines and economic growth slows. Here is an article about deflation and I

have included (below) the key passage (https://www.thebalance.com/what-is-deflation-definition-causes-and-why-it-s-bad-3306169):

· Deflation

slows economic growth. As prices fall, people put off purchases. They hope they

can get a better deal later. You've probably experienced this yourself when

thinking about getting a new cell phone, iPad, or TV. You might wait until next

year to get this year's model for less.

· This

puts pressure on manufacturers to constantly lower prices and develop new

products. That's good for consumers like you. But constant cost-cutting means

lower wages and less investment spending.

For much of the

10-plus years after the global financial crisis, central banks sought to induce

inflation and the US Federal Reserve set an inflation target of 2%,

annually, which it struggled to achieve. Here is a quote from one of many articles on the topic from 2015 (https://www.cnbc.com/2015/10/13/the-us-is-closer-to-deflation-than-you-think.html.):

· Nonvoting

member James Bullard, who heads the St. Louis Fed, is among those pushing for a

rate increase, as he believes policy has helped make “cumulative progress

toward committee goals,” as he said in a speech Tuesday.

· Fed

Gov. Lael Brainard, who does have a vote on the FOMC, countered that

deflationary pressures argue against an increase.

· Our

economy has made good progress toward full employment, but sluggish wage growth

suggests there is some room to go, and inflation has remained persistently

below our target,” Brainard said in a speech Monday. “With equilibrium real

interest rates likely to remain low for some time and policy options that are

more limited if conditions deteriorate than if they accelerate, risk management

considerations counsel a stance of waiting to see if the risks to the outlook

diminish.

How Inflation Might Be

Used to Address Our High Levels of Debt

Inflation is likely to

be higher over the coming years not only because of Covid stimulus, infrastructure, and climate spending, but also

because higher inflation addresses a more fundamental problem the US and other

countries have. The article below requires a subscription, but I have included

key sections below (https://www.bloomberg.com/opinion/articles/2021-11-16/greenspan-s-bond-yield-conundrum-has-returned-to-haunt-markets):

The writer, John

Authers, does a good job of laying out a few key points:

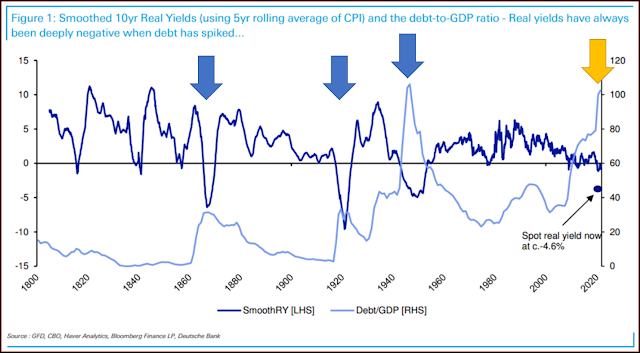

- This

chart is from Deutsche Bank’s indefatigable financial historian Jim Reid and

goes back to 1800. It compares debt/GDP ratio with real yields defined as the

prevailing 10-year rate subtracting the five-year rolling average of

inflation:

[Note

from JHansen: The above chart focuses on just the US. I have added three big

blue arrows to indicate the three earlier periods of low real yields

(dark blue line labelled “SmoothRY”) and high Debt-to-GDP ratios (light blue line), plus, in yellow, the current period.

The key thing to note is the high debt-to-GDP levels under the four arrows.

Generally speaking, high levels are bad.]

· On

this view, real yields have been as low as this three times before in the last

200 years: during the U.S. Civil War, the Great Depression, and finally in the

aftermath of the Second World War. In all cases, for obvious reasons, debt

spiked. That has happened again [yellow arrow, JHansen], although not for

reasons as horrific as a war or a depression.

· The

low real yields associated with the Second World War came during a period of

explicit “financial repression” when the government held them [real bond

yields] low to make it easier to pay off the debts incurred to finance the

conflict, and the Fed had to surrender its independence for a matter of years.

The Reid hypothesis is that with another epic debt pile to pay off, another

episode of financial repression lies in our future. He also suggests that a

combination of inflation (to reduce the value of the debt) and repressed yields

(to make it cheaper to service) mean that real yields will stay negative for

the rest of his career, and that this unenticing option is superior to the

alternatives:

· Financial

repression has always won out. The previous debt spikes occurred around the

Civil War, WWI and WWII. This latest climb had been steadier (but substantial)

until Covid, which may explain why real yields have steadily but consistently

declined. However, the economic response to Covid has been more akin to a war

time response, with debt and spot real yields both spiking in opposite

directions just like that seen around and after the wars discussed above.

· [W]ithout

financial repression, real yields would likely be consistently positive at the

moment given the weight of global debt. But given this global debt pile, that

would strongly increase the probability of financial crises across the world.

So the risk to my “rest of my career” view is that something happens in the

years ahead that prevents the authorities using financial repression. If this

occurs then the global financial crisis may look like a dress rehearsal for a

much bigger event. So the incentives for the authorities are there.

· Beyond

that, a world of financial repression would continue to be a world of TINA,

where we are left grudgingly to buy stocks because There Is No Alternative

[TINA = There is no alternative. Low yields mean that bonds deliver lower returns to investors. - JHansen]. It’s not appealing, and arguably

it’s not really capitalism, but it might be the best way forward. It’s also a

worryingly good explanation for the continued low long yields.“

Low “real yields”

means that the yield on bonds is low compared to the inflation rate, and “long

yields” are yields on long term bonds.

"Financial repression" is known to those at the Fed. Here is quote from a Fed paper on the topic (https://www.richmondfed.org/publications/research/econ_focus/2021/q1/economic_history):

A Tool of Debt Liquidation: In many countries during 1945-1980, financial repression effectively lowered the real returns to government debt holders and helped governments reduce their debt-to-GDP ratios, according to research by Reinhart and M. Belen Sbrancia of the IMF. Based on their calculations, real returns on government debt were negative in many countries over 1945-1980. The real returns to bond holders averaged -0.3 percent in the United States, and real returns were even lower on the bonds of those European governments that had been particularly ardent practitioners of financial repression, coming in at -6.6 percent in France and -4.6 percent in Italy. ... Ever since McKinnon and Shaw, financial repression has been associated with inflation...

Given this

discussion, we might expect 1) bond yields and interest rates to increase enough to introduce greater

sensitivity to stock valuations over the short term and improve only slightly

the long-term return to some bond sectors, 2) interest rates still low enough to encourage

economic growth despite there being elevated inflation. 3) some upward pressure on stock prices because stocks have pricing power and can pass on any their higher costs to their customers, If this does turn out

to be the case, investing in stocks will be most beneficial because of TINA –

there is no alternative.

One Final Opinion:

Expect to “Muddle Through” as Opposed to Expecting a “Crisis to be a Cleanser”

When I started in the

investment business years ago, I thought of the economic and stock market

cycles as periodic waves of getting rid of the old, inefficient aspects of the

economy and allowing new ones to grow. While this rhythm does indeed take place,

the periodic purges and sprouting new ways have never been as big as I thought

they should have been. It is true that when the housing crisis started in 2007, it

seemed that financial leverage and novel ways of packaging investments had

become excesses before the crash of 2008, and these excesses were addressed.

When the dot-com

bubble inflated in the late 1990s, there was much talk about the extreme

valuations of companies with little or no revenue, and the subsequent bust of

the bubble addressed those excesses. After the run-away inflation of the 1970s,

it was clear that inflation had to be addresses, and Paul Volker increased

interest rates and inflation was tamed by the early 1980s.

To be sure, these were

major adjustments, but it surprised me at those times just how much of the

economy continued and absorbed these changes. It surprised me how much stayed

the same.

I think I had in mind

the experience of the Great Depression when the stock market dropped about 80-plus percent, the economy in the 1930 was indeed a shambles, and it took years (and probably

WWII) to get back on its feet. After that collapse, the economy and the country

were completely different in many ways. I think I was expecting change of

similar magnitude. But now, I realize that this expectation was unrealistic.

The economic collapse

after the 1929 stock market crash was different. At the time the Fed and the

government responded with a tough-love approach. There were government and

business leaders who expected and maybe even welcomed a cleansing crisis that

would abolish the excesses and provide fertile soil for new economic growth.

This is a quote from a very interesting Federal Reserve history piece (https://www.federalreservehistory.org/essays/great-depression):

· A

few governors subscribed to an extreme version of the real-bills doctrine

labeled “liquidationist.” This doctrine indicated that during financial panics,

central banks should stand aside so that troubled financial institutions would

fail. This pruning of weak institutions would accelerate the evolution of a

healthier economic system. Herbert Hoover’s secretary of treasury, Andrew

Mellon, who served on the Federal Reserve Board, advocated this approach.

However, as the

article indicates, this view is now considered by the Fed to be a mistake.

Instead, during a crisis the Fed should be very benevolent so the economy does

not collapse and gets back to growth quickly – economic growth addresses many

problems. One need only look at the response to the Covid crisis to see that this

mindset still prevails at the Fed and in our broader government, which have been

excruciatingly benevolent. But the Fed has concluded, rightly I believe, that

addressing the subsequent excesses resulting from benevolence when the economy

is stronger is much better than not being benevolent during a crisis.

This means that we

will muddle through each crisis and muddle through the effects of the remedies

used to prevent economic collapse during each crisis. At present, this means

addressing inflation while promoting economic growth and allowing the debt

level to shrink in proportion to the growing economy.

I expect the Fed to

allow the economy to run “hot,” which means that it will encourage economic

growth and allow a moderate level of inflation to take place. Stocks will be

likely be the main investment that produces a strong return in these future

conditions. Thus, after an initial period of recalibration and potential

decline, I expect stocks and to be influenced by the natural cycles of resilience.

I always pay attention to what Jeremy Grantham says. He may be right about a big decline that results in lower stock valuations. But even during the collapse of the internet bubble in the early 2000s, the natural cycles of resilience still allowed the MRI-based process to generate good returns. The same was true in the 1970s with its high inflation and the 1980s when inflation was fought. The same was true before and after the stock market peak in 1929. I expect our portfolios to do well in the environment described above and in other environments that are used to muddle through. The natural cycles persist.

Again, the implication

for us is to get out of the stock market when it is vulnerable and to be ready

to participate later in the growing

economy, to earn high returns in our portfolios, and to keep well ahead of

inflation when markets are resilient.

----------