Review of

2020 Performance

I. Model Portfolios Performance

o

Main Model Portfolios in Diamond Publication

§

Diamond 70-30 (sg131)

§

Diamond-Onyx 35-65 Mix (sg218)

o

Select Model Portfolios in Sapphire Publication

II. Performance of the Building Blocks (Sleeves) of the Model Portfolios

o

DJIA Loss Avoiding Sleeve

o

Onyx Sleeve

III. Analysis of 2020 Performance for the DJIA Loss Avoiding Sleeve

o

A Period of High Resilience Began in Late 2019

o

The 2020 DJIA Price Decline Was Rapid, So Was

the Recovery

o

The Micro MRI Oscillated Quickly in 2020

Please see this webpage for a discussion of the terminology

used in this report.

https://focused15investing.com/language

I. Model

Portfolio Performance

The table below (Figure 1) shows the performance of the two

main model portfolios in the Diamond publications:

- Diamond “sg131” – Designed to have a level of variability similar to the DJIA

- Diamond-Onyx 35-65 Mix “sg218” – Designed to have variability similar to a mix of 60% stocks and 40% bonds

The performance figures do not incorporate any cash held in

accounts associated with the “Box #2 Cash” level that users can determine on

their own or using my guidance. The other model portfolios on the weekly

publications have structures similar to these but are either more aggressive or

less aggressive.

Both model portfolios are designed to have a high

return-to-variability ratio (RoR/Var). An

attractive return-to-variability ratio is 1.0 or higher over multi-year

periods. Over a period of under a year

or so, it is sometimes useful to look at the maximum loss (drawdown) over the

period as an alternate measure of variability.

Figure 1. Performance of the Two Main Model Portfolios in

the Diamond Publication

DIAMOND 70-30 (sg131)

The Diamond 70-30 “sg131” model portfolio, listed in row 1

of Figure 1, is designed to have a level of variability about the same as the

DJIA. We can see in column D that the variability

of sg131 is 17.20% over the six-plus years since the Focused 15 Investing

publication began. The variability of

the DJIA over this six-plus year period is 18.30%, which is reasonably close. Recall that for variability, lower is

better.

The model portfolio sg131 had a return of -5% for 2020

(column A). The DJIA (row 3) returned 9%

for the same period. This is an

undesirable result for the model portfolio.

The table also shows that sg131’s maximum loss for 2020 (B)

was -34% for the model portfolio. For

the DJIA it was -35%. From this

perspective, the model portfolio met one of its objectives, which is to have a

level of variability similar to the DJIA.

Over the last six-plus years of the Focused 15 Investing

publication, the model portfolio returned (C) 13.8% (annualized) compared with

12.2% for the DJIA. It did so with a lower level of variability (D) of 17.2%

compared to 18.3% for the DJIA. The

return-to-variability ratio (F) of 0.80 is higher (a good attribute) than that

for the DJIA of 0.67. Long-term, I aim

to have a return-to-variability ratio for the model portfolio exceed the

reasonable alternative by 0.30. From

this perspective, the poor 2020 return-to-variability for sg131 has caused this

ratio to fall below that aim for the six-year period.

Over a longer term, however, sg131 has strong

return-to-variability ratio compared to the DJIA. Column I shows statistics from January 2000

through the end of 2020. These

return-to-variability statistics are more consistent with the objectives for

the model portfolios. Since 2000, the

DJIA experienced declines from 2000 through 2003 and 2007 to early 2009 – both

of which occurred at a pace similar to other major declines over the last 100

years – the approach navigated these effectively. In a later section, I show

the pace of declines in the major declines of the last 100 years, which

underscores the rapid pace of declines in 2020.

DIAMOND-ONYX 35-65 MIX (sg218)

Diamond-Onyx 35-65 Mix “sg218” model portfolio is designed

to have variability close to an alternative that mixes stocks and bonds at the

ratio of 60/40. The Vanguard fund VBINX is a well-known 60/40

fund.

In 2020, sg218 had a maximum loss of -20%, compared to

VBINX’s loss of -22%. Which is a positive

result for sg218.

However, sg218 performed worse than VBINX in 2020, with a

gain of 10% compared to VBINX’s gain of 16%.

Over the six-plus years through the end of 2020, sg218 had

much better returns (C) than VBINX. It returned 13.85%, compared to VBINX’s

9.20%. The return-to-variability ratio

for sg218 is 1.21, compared to 0.86 for VBINX.

This higher ratio is consistent with the performance objective of the model

portfolio.

One might wonder if the Onyx mixes are simply better model

portfolios than the DJIA-focused portfolios (e.g., Diamond sg131). I designed the Onyx mixes in 2013 to have

stable returns and to perform well in low and variable interest rate

environments. The Onyx mixes have

performed well – with strong and consistent returns – since their

inception.

However, there will be times when the Onyx mix returns are

lower than the returns of model portfolios emphasizing only a DJIA-focused

sleeve, such as Diamond sg131. This is

evident in the better performance figures for the DJIA-focused portfolios after

the 2007-2008 stock market declines associated with the global financial

crisis. In 2009, Diamond sg131 returned

39%, compared to 27% for the Diamond-Onyx Mix sg218. For comparison, VBINX returned 18% and the

DJIA returned 19%.

SAPPHIRE PUBLICATION

The table below (Figure 2) shows similar information for two

model portfolios in the Sapphire publication. Both mix a DJIA segment (sleeve) and an Onyx

sleeve. These two model portfolios have

a structure similar to the Diamond-Onyx Mix sg218, with the biggest difference

being the use of the ETF “UDOW” for the DJIA instead of the ETF DDM.

These model portfolios are designed for subscribers with

long investment horizons and are more aggressive than the Diamond model

portfolios. The Sapphire portfolios have

higher returns and variability measures.

The portfolios are designed to have an attractive return-to-variability

ratio, which is a ratio greater than 1.0.

Figure 2. Performance of Two Model Portfolios in the

Sapphire Publication

The Sapphire-Onyx mix portfolios underperformed the DJIA in

2020, as shown in column A. But the

longer-term returns are quite a bit higher, as show in columns C and G. The return-to-variability ratios are also

more consistent with longer term return-to-variability objectives for Focused

15 Investing model portfolios (columns F and I).

II.

Performance of Important Building Blocks (Sleeves) of the Model Portfolios

DJIA Loss Avoiding Sleeve

I will use the Diamond sg131 to represent the Diamond

sleeve. Figure 3 below shows the

performance of sg131 and the DJIA throughout 2020. The lines move in tandem from the first of

the year to early June. From June 19

through mid-November, the performance of the model portfolio was flat.

Figure 3. Performance of DJIA and Diamond (sg131)

I discuss 2020 performance for this sleeve in greater detail

below.

Onyx Sleeve

The Onyx sleeve performed well in 2020. Figure 4 below shows

the performance of the Onyx sleeve that is present in Onyx mixes in the Diamond

publication. It also shows the DJIA for

comparison.

Figure 4. Onyx Sleeve and DJIA Performance

The Onyx sleeve had a return of about 13% for the year,

which is very close to its long-term average of 12% (annualized return since

January 2000). Onyx avoided the major

losses of the year and outperformed the DJIA.

Although not shown in Figure 4, the benchmark (“neutral mix,”

an equal-weighted mix of the four low-variability ETFs used in this sleeve) for

the Onyx sleeve returned 9.9% for the year.

In addition, the sleeve had lower variability and a smaller maximum loss

for the year, as shown in Figure 5 below.

Figure 5. Onyx

Sleeve Performance Statistics for 2020

The Focused 15 investment approach worked as expected for

the Onyx sleeve. Model portfolios that contain the Onyx sleeve outperformed the

portfolios that did not contain the Onyx sleeve. I do not offer the Onyx sleeve

as a separate model portfolio. It works

best in combination with another sleeve because in strong stock markets, the

returns of the Onyx sleeve alone are meager.

For the balance of the report, I will focus on the DJIA loss-avoiding

sleeves as represented by the Diamond sg131 model portfolio.

III. Analysis

of 2020 Returns for the DJIA Loss-Avoiding Sleeve

This section discusses the reasons for the 2020 model

portfolio performance based on the DJIA loss-avoiding sleeve. I will use the Diamond sg131 model portfolio to

represent this sleeve.

The conclusions are:

- The global pandemic produced both a rapid economic contraction and an almost simultaneous massive government-led program to stimulate economic expansion.

- The two main elements in the DJIA Loss-Avoiding approach performed as expected.

- The Market Resilience Indexes (MRI) were reasonably responsive in tracking the pricing dynamics of the stock market in 2019 and 2020.

- While the algorithms that determine the target weights from the current MRI conditions performed as programmed, they missed two points at which the DJIA moved higher because of very positive news events. The approach does not respond to news events – instead, the news must influence stock prices, and the approach detects those influences. In 2020, however, the news events were especially consequential – the government stimulus (end of March) and the announcement of an effective vaccine (early November). These events quickly produced strong returns.

- While performance of the DJIA loss avoiding sleeve was poor for 2020, I have confidence in the MRI and the algorithms. At this time, I believe the pandemic and responses will not be typical of future economic environments. Rather than considering 2020 as typical year to guide us in the future, I believe that it is better to instead consider the market dynamics of the last 100 years for insights about future dynamics.

- A change that has been made in response to 2020 is that I am that am judgmentally adjusting Box #2 cash levels, as needed (even outside the regular Friday trading schedule), when a period of Exceptional Macro resilience ends.

A Period of High Resilience Began in late 2019

After declining since early 2018, the Macro MRI began to

move higher on October 11, 2019. This move

higher in the Macro MRI coincided with a move higher in the DJIA. Figure 6 below shows the DJIA price line from

January 2019 through the end of January 2021. The large green arrow indicates

the beginning of the upleg of the Macro MRI, and the small green arrow

indicates the beginning of the period of Exceptional Macro resilience.

Figure 6. DJIA Price (January 2019 through January 2021)

and MRI Direction Changes

These shifts towards increased resilience could reasonably

be expected to be the beginning of a strong bull market that could last many

quarters. The Macro MRI had been

declining for almost two years and was at a relatively low level compared to

its historical levels, which gave it ample upside potential. The Focused 15 approach navigated the 2019 period

reasonably well.

Focusing just on the 2020 period, the Exceptional Macro

ended at the end of January (small red arrow) for the DJIA and many other indexes.

The end of the positive Macro MRI occurred in late February (large red

arrow). These shifts represented a rapid

deterioration of resilience, which I believe was in response to growing

awareness globally of the risk of a pandemic.

The algorithms responded by reducing the target weight for the

DJIA-linked ETFs, which reduced subsequent losses. However, the reduction was not large enough

considering the subsequent decline. I

discuss the pace of the 2020 declines in the next section.

Going forward – and this is perhaps the biggest change to

the investment process resulting from the 2020 experience – I will issue

guidance to reduce allocation to stocks when the Exceptional Macro ends across

several indexes. I will do this by

suggesting that subscribers (particularly those who are sensitive to losses) raise

Box #2 Cash on the Shares-to-Trade worksheet outside of the regular Friday

trading schedule. I have discussed this

in this blog post:

https://marketresilience.blogspot.com/2021/02/weekly-note-february-3-2021.html

The 2020 DJIA Price Decline Was Rapid, So Was the

Recovery

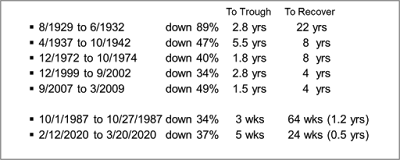

Figure 7 below shows major declines in the DJIA over the

last 100 years. Our investment approach

navigated (in historical simulations) the five listed in the upper section

quite well. These declines took from 1.5

to 5.5 years to reach the bottom of the market from the most recent peak.

Figure 7. Major Declines in the DJIA over the Last 100

Years

The sharp decline of 1987 lasted just three weeks. Our loss-avoiding approach did not avoid this

decline. The last decline listed is the

2020 decline, which took place over five weeks.

The 2020 decline stands out from all of these declines in that the

recovery has been rapid. After the 2020

decline, it took just 24 weeks for the DJIA to recover to the prior peak. This recovery is far faster than any of the

other declines listed.

The Micro MRI in 2020

The main purpose of the Micro MRI is to closely track the

week-to-week movements of the market and accurately mark important inflection

points in the market. In 2020, the Micro

did this reasonably well in the first half of the year as shown in Figure 8

below. This figure shows the 2020

performance of the DJIA loss-avoiding sleeve (as represented by the Diamond

sg131) as the heavy black line, and the DJIA as the dark brown line. Both are

in the upper part of the figure and use the scale on the right.

The figure also shows the Micro MRI (green line). The Micro MRI is designed to move around a

center line, shown as the yellow horizontal line, using the scale on the

left. The points labelled A through I

indicate inflection points in the Micro MRI.

The Exceptional Macro is shown as the brown lines at the

bottom of the figure. When they spike

up, the Exceptional Macro is present.

The figure does not show the Macro MRI.

Figure 8. 2020 Performance of DJIA and Diamond (sg131),

Plus Select MRI

The declining Micro MRI indicated weak short-term resilience

from the beginning of the year (A).

Through the end of January, the presence of the Exceptional Macro (prior

to J) and the positive Macro MRI (not shown) caused the algorithms to place a

lower weight on the declining Micro MRI.

Point B (March 20) indicates the bottom of the market, and

the Micro MRI did a good job identifying the DJIA price move higher from that

point. The CARES relief act was passed March

27. From B to C, the Micro MRI effectively indicated the path of stock

prices.

The declining Micro from C to D was initially

effective. However, prices moved higher

in early July (L) while the Micro continued to decline to D. The inflection point at D was problematic in

that it occurred very close to the center line.

Historically, when that has occurred, subsequent declines have often been

abrupt and deep, and the algorithms are programmed not to respond aggressively

to the Micro MRI moving higher from a point close to the center line. That pattern does not always happen, but the

declines are typically big enough that the long-term risk and return statistics

are better if one does not try to capture the returns. That is why we see the beginning of the

horizontal line for the sg131 performance.

From D through the end of the year, there were three more

peaks in the Micro (E, G, and I). E and

G could have easily been the beginning of a steep price decline that would be

more consistent with historical norms.

Soon after peak G, the Micro declined, but the DJIA moved

sharply higher in early November when Moderna announced an effective

vaccine.

There were five peaks in the Micro (A, C, E, G and I) in

2020. This is a high number; two or

three is more typical in a single year.

The MRI are designed to adapt to the market, but the forces in 2020 were

too extreme and varied.

The algorithms did not attempt to pursue these ups and downs

in the Micro MRI. Thus, there was a

continuation of the flat performance line for sg131. Not chasing these moves probably

helped performance. Had the algorithms attempted to respond to these rapid

oscillations, they might have been too late or slow to exploit them,

considering our weekly trading discipline.

Once can see that starting with E, the inflection points in the Micro

MRI lag those in the DJIA, which makes the algorithms less effective. Instead, they waited until after H when the

rapid Micro MRI oscillations had ended.

The events and market dynamics of 2020 may not be repeated

in the future. I do know that the

MRI-related market dynamics are remarkably consistent across the prior 100

years, and I believe it is safer to assume that future will be more like the consistent

picture covering 100 years than like 2020.

end

The Diamond model portfolios make

prominent use of the leveraged stock ETF “DDM,” which magnifies the return of

the DJIA two times (x2) each day. In the

name of the model portfolio, I indicate the maximum weight of this leveraged

ETF using the loss-avoiding signals for the DJIA. For example, the model portfolio DIAMOND

70-30 – 3 ETFs (sg131) has a maximum of 70% in DDM. This means that when the DJIA is determined

to be most resilient, the portfolio is intended to produce 140% the return of

the DJIA each day (positive or negative), all else equal. This model portfolio is designed to have

variability similar to that of the DJIA.

Variability refers to how much the returns go up and down (and is often

measured in the investment industry as the annualized standard deviation of

weekly returns). Lower variability is

better.