Sections in this post:

A. Confusing Time

B. This Type of Divergence is Expected and Why We Focus on the DJIA

C. The Spread Between Leading and Lagging Sectors is High

D. Not Yet a Bull Market for the DJIA

E. High Stock Valuations

F. Corporate Earnings Have Not Yet Declined

G. A Period of Low Investor Excitability Has Just Ended

H. But There is Progress Toward Stronger Markets

A. Confusing Time

This is a confusing time in the markets. A recent headline declared the end of the declines in the stock market…

“The bear market in stocks has officially ended and a new bull market has kicked off. Here's why investors can expect more gains ahead.” (LINK)

By Matthew Fox Fri, June 9, 2023 at 3:13 PM PDT

The longest bear market since 1948 is officially over after the S&P 500 closed above 4,292 on Thursday, representing a 20% rally from its October 12 closing low of 3,577.

The threshold was reached on the back of better-than-feared corporate earnings, a resilient economy and job market, and the expectation that the Federal Reserve is about to pause its aggressive cycle of hiking interest rates.

Yet not all parts of the stock market have received the

news. While the tech-biased NASDAQ stock index is moving higher quickly (likely

sparked by the AI theme) with year-to-date performance through last Friday

(June 9) of 33%, the DJIA has lagged. It has had a return of 3% over the same

period. The technology sector of the economy and stock market is currently a

breakaway sector. I explain why the DJIA and NASDAQ have had such different

performance and why we should be okay with this difference, even if it is

painful.

But the key points for you as an investor are:

- Be patient with recent performance - it has been lackluster this year for most of the stock market.

- Do not switch portfolios to try to get higher returns

- The difference between top performing ETFs (leading) and bottom performing ETFs (lagging) is large by historical standards in normal times. If one chases performance and switches to a portfolio or ETF that has recently been leading one runs the risk of selling ETFs that will be lead in the future and buying ETFs that will lag.

- Be cautious of what the business press says. Many have said the bear market is over. It seems to be over for the tech sector and the NASDAQ, but it not quite over for the rest of the economy and stock market outside of technology.

B. This Type of Divergence is Expected and Why We Focus on the DJIA

This type of situation is exactly why we focus our portfolio

on the DJIA and not on what we in the investment industry call “market-capitalization

weighted” indexes, such as the Russell 1000 (consisting of 1000 companies) and

the S&P 500 (consisting of 500 companies). These market capitalization-weighted

indexes seek to invest in all major companies in an economy and in all its economic

sectors (Energy, Consumer Staples, Utilities, Technology, etc.). The weight of

each company in the index is determined by price of its stock and the number of

stock shares it has in the marketplace. The higher the price goes the more

weight it is given in the index. These indexes have advantages if you are

investing billions of dollars.

This type of index also works fine for individual investors when stock

price appreciation is spread evenly across all economic sectors, but it can

cause trouble when one sector experiences abnormally high price gains; when it

becomes a breakaway sector. If the companies in one sector do better than companies

in other sectors, that sector is weighted more heavily in the index.

Two sectors that have tended to be breakaway sectors in the

past are technology and energy. The technology sector became a breakaway sector

in the late 1990s with the Internet/Dotcom boom. Energy was a break away sector

in the 1970s and 1980s.

As the breakaway the sector did better it got a higher

weight in broad stock market indexes such as the S&P500. And it got to its highest weight in the index

at the very peak of its performance cycle.

This happened to the tech sector in early 2000, just before

the technology bubble collapsed. As individual investors, we do not want that. We

would like to have less weight in a breakaway sector at the peak of its performance

cycle.

In contrast, the DJIA focuses on 30 companies and does not

seek to have full representation of every sector in the economy. The weights of

individual companies and sector weights do not change as dramatically over time

as they do in market-capitalization weighted indexes. This is because it selects

just a few high-quality companies for inclusion and uses an archaic weighting scheme.

The result is greater consistency in the weighting of the 30 companies. The net

effect is that it is less prone to give the highest weight to an individual

company or a sector at the top of its performance cycle.

The link to our ETF holdings page (https://marketresilience.blogspot.com/p/etf-holdings.html)

shows the weight of stocks in the DJIA and NASDAQ-100. You can see that the largest holdings in the

DJIA are smaller than the largest holdings in the NASDAQ – a

market-capitalization weighted index. That means the DJIA is less concentrated

in a few specific companies.

In our early research on stock indexes, we found that the DJIA

gives more reliable signals indicating its future direction than do the

S&P500 or Russell 1000. We believe the small number of high-quality companies

it holds (30) and its archaic weighting scheme contribute to its reliability. Thus,

in addition to the advantage of its long history, we found its signal reliability

very attractive, and the DJIA is our core stock index.

We also find it is better to make decisions about the

technology and energy sectors of the stock market separately from the rest of

the economy; they follow their own independent cycles and series of inflection

points.

At this time, technology is a breakaway sector. NASDAQ has a

roughly 58% weight in companies in the technology sector, with the S&P500 having

28% in tech. The DJIA has an 18% weight in the sector. While the NASDAQ and to an extent the S&P500 rocket higher with tech, the DJIA and other sectors are still on the ground. The other

sectors of the economy are is contending with concerns about slower growth

brought on by higher interest rates, inflation, and a possible recession.

The impact of tech on the S&P is discussed in an article I've posted over the last few weeks: https://www.axios.com/2023/06/01/sp500-tech-companies-stock-price.

The strength of the current stock market in the technology

sector may be influenced by the hype about ChatGPT and AI. Should they fail to

live up to the hype (which is likely) the tech sector may

experience a meaningful decline. It could then drag down the indexes, such as

the NASDAQ and S&P500, that have high weights in the tech sector. We may

find that the press article I mentioned at the beginning of this post is not as

strong as it currently seems.

C. The Spread Between Leading and Lagging Sectors is High

Our stock ETFs tend to have low exposure to technology and

have lagged the technology sector. The conservative stock ETFs of XLP (consumer

staples companies) and XLU (utility companies) have performed poorly. These lagging indexes are fighting the

battles with inflation and a possible recession (although the threat seems to

be receding).

- DJIA: -3% in May 2023

- Cons Staples: -6%

- Utilities: -6%

- NASDAQ: 8%

Figure 1

Over the 18 months shown above, all indexes/ETFs had positive returns in half the months except Consumer Staples (XLP), which had slightly fewer (8 out of the 18 months were positive).

The turquoise bar in Figure 1 above indicates the difference, or spread, between the top, “Max,” performing index (NASDAQ at 8%) and the bottom, “Min,” performing (Consumer Staples at -6%) for May, which is 14 percentage points. Over the months shown in Figure 1, we can see that the level of 14% is the second highest of the period. In March of 2022, the difference was 16%. Over the 18-month period shown, NASDAQ, shown as the purple bar, is sometimes very positive and sometimes very negative, which reflects the boom-and-bust pattern we see in technology stocks.

For clarity, Figure 2 below shows only the Max-Min line over the same period. It shows 14% for May.

Figure 2

You can see more clearly that the recent spread between the

top and bottom performing ETF in May was indeed among the highest.

Figure 3 below shows the monthly Max-Min line over a longer timeframe, going back to January of 1990. A key point is that the current high level of about 15% is quite high by historical standards except for the Internet boom and bust that ran from about 1997 to 2003.

Figure 3

From this perspective, the current outperformance of NASDAQ may be at the extreme and it may be reversed over the near future. To invest heavily in NASDAQ now may risk investing in it just as it begins to underperform the others. The Micro MRI for the NASDAQ was at the 87th percentile last Friday - a high level. Thus, we will move into NASDAQ opportunistically.

There have been several periods over the last 100+ years in which there have been large spreads between the DJIA and breakaway sectors such as technology and energy. Even considering these periods, the historical simulations indicate that our strategy can produce high return and low variability.

D. Not Yet a Bull Market for the DJIA

Figure 4 below indicates the status of the Macro MRI for key

indexes. This first column indicates whether the Macro MRI is now in the upleg

of its cycle. The second indicates the Macro’s level (percentile) compared to

its own history. Third, whether the Exceptional Macro is present. Fourth,

whether the index could be described as being in a bull market as indicated by

the Macro MRI being in the upleg of its cycle and the presence of the

Exceptional Macro. The inception date of the index.

Figure 4

Historically, bull markets are most reliably indicated by

the DJIA. Thus, that the DJIA has not made a full shift is worth noting. It is

best to follow our discipline which is to pay most attention to the DJIA, which

suggest caution at this time.

The current status is somewhat troubling because the physics-based

drivers we’ve recently developed indicate that the Macro MRI had an opportunity

to begin its upleg last September. The NASDAQ seems to have responded to that

driver, but the DJIA has not.

For the DJIA, the beginning of the Macro’s upleg was late

and the Exceptional Macro made sporadic appearances, which is not at all

typical. Looking back over the last 100 years, the Macro MRI has been more

responsive to the driver. We suspect that the lack of major declines in stocks

over the last 18 months has allowed high stock valuations to persist, and that

this is a major factor in the lackluster stock returns outside of the tech

sector. The DJIA seems to suggest there is unfinished business from the last year and a half.

E. High Stock Valuations

Figure 5 below shows that the current valuations levels are

still high for the DJIA. When valuations are high, stock prices tend to move

lower. When valuations are low, stock prices tend to move higher. This is a version

of buy low and sell high.

The important Price/Book and Price/Sales ratios for the DJIA

are still high by historical standards, at the 83rd and 88th

percentile, respectively. This is a high level compared to the historical

refence points (A, B, and C) shown that are the low points of the DJIA price

levels (after large declines), just before a bull market begins.

Figure 5

It appears that investors in general have not been concerned by these high levels. The same is true for companies in NASDAQ. Figure 6 below shows the same table for the NASDAQ 100.

Figure 6

The important Price/Book and Price/Sales ratios are still

high by historical standards, at the 91rd percentiles for both. This

is a high level compared to the historical refence points (A, B, C, and D) shown

that are the low points of the NASDAQ price levels (after large declines) just as

a bull market begins.

F. Corporate Earnings Have Not Yet Declined

By some measures, corporate earnings have not yet shown the

declines that might be expected after a bear market. Figure 7 below shows the

DJIA (brown line, log scale) and our measure of “Economic Load” (orange) on the

stock market. Economic Load is our composite of valuation statistics, change in

short-term interest rates, and a comparison of stock dividend yield to bond

yields. The higher the orange line, the

more downward pressure there is on stock prices and corporate earnings (double

blue line).

Figure 7

|

|

|

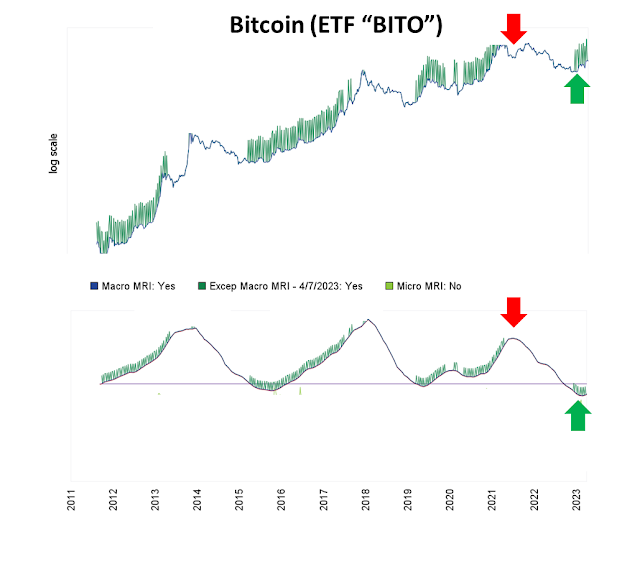

G. A Period of Low Investor Excitability Has Just Ended

This lack of concern about valuations economic load could be

related to the period of low investor excitability we have just passed

through. At the beginning of 2022, we indicated that the next several months could

be expected to have muted price cycles – an indication that investors will not

get excited about either good news or bad news. This view is based on our

recent research on the drivers of resilience. That same research suggests that the

calm is over and that investors will now be much more excited about both good

news and bad news. We may find that investors will now be more concerned about

valuations and favor lower prices for stocks. If true, the reliability and the

current conservative nature of the DJIA will be to our advantage.

H. But There is Progress Toward Stronger Markets

I do think we have begun a new long-term trend toward higher

stock prices. The stock market has been battling headwinds since the end of

2017, and this has been a very challenging period. But that period appears to be over. The Macro

MRI for most all stock indexes are at low levels and moving higher. There will still be challenges but instead of

headwinds fighting our progress, we are likely to have tailwinds the help us

along as we work through the short-term challenges presented by the markets.